By Arihant Paigwar

An article in Nature Ecology & Evolution identifies conservation abandonment as a significant and largely overlooked policy area that hinders global conservation efforts. According to the paper “Conservation abandonment is a policy blind spot,” the widespread failure to implement conservation promises puts large international goals, such as the Kunming-Montreal Global Biodiversity Framework‘s aim to protect 30% of the land and oceans by 2030 at risk.

After their paper conceptualises conservation abandonment as a failure combination, the authors first depict the failure of regimes to perform conservation actions even after the signing of the agreements, resulting in “paper parks” that are only a term in documentation and have not been truly protected. Secondly, among the changes in the natural world, there is one called Protected Area Downgrading, Downsizing, or Degazettement (PADDD), which describes the legal court’s decision to cancel or reduce the administration of the area.

In their analysis of 3,749 PADDD cases in 73 countries between 1892 and 2018, they discovered that the protective statuses were lessened or removed over an area equivalent to the size of Greenland. One of the most important discoveries among their different findings was the strong relationship (directly linked to two-thirds) between the rollbacks and the performance of industrial-scale resource exploitation, such as mining, oil drilling, and large infrastructure projects.

The costs might be expected to rise over $540 billion by 2030, while the present global conservation effort is very conservatively estimated to be $87 billion per year and may exceed $200 billion depending on what is included. But Matthew Clark, a postdoctoral researcher at the University of Sydney, thinks that “No one can say how long these programs are going to last, but we certainly don’t have much of a line of sight.”

Studies also reveal that at least one out of every three conservation projects is abandoned within two years following the implementation. Clark adds that “This blind spot may very well signal the progress at COP type of events as real ecological recovery takes decades.” One of the biggest threats that have led to this situation of non-achievement of environmental goals is the lack of accountability and sustained effort.

The abandonment of conservation has been gaining momentum all over the globe. For example, the people of Chile were initially allocated 22% of the Territorial Use Rights in Fisheries, which, however, were later withdrawn. Specialists estimated that a portion of conservation-related community organizations in the southern and eastern regions of Africa which after that abandoned the management of their areas or changed their boundaries and regulations. Even “Other Effective Area-Based Conservation Measures” (OECM), which are recognized by GBF, are going through the change process. Two countries, Canada and Morocco, have together removed seven OECMs that cover over 2,400 square kilometres, and a vast maritime OECM has been authorized for exploratory oil drilling.

According to this report, abandonment dominates most of the regions with land use under heavy pressure and a decline in external funds. Society and culture changes, like secularization leading to less conservation of the holy natural sites, also affect the trend. Moreover, the paper identifies economic and political changes as the greatest risks. After the US government cut $365 million in international conservation assistance, it removed legal protections from ecologically vital areas like the Pacific Islands Heritage Marine National Monument and all 18 of California’s national forests in February 2025, the paper states. Europe right-wing populist parties, e.g., several of them, have been opposing the EU’s Green Deal whereas environmental rollbacks in Brazil under Jair Bolsonaro’s presidency (2019–2023) have led to the global conservation movement’s decline getting faster. The authors argue that if the issue of conservation abandonment is not addressed, it will be a substantial obstacle to the means of reducing biodiversity loss and meeting the global warming 1.5 C target.

By Arihant Paigwar

The increasing volatility and intensity of weather events, such as the October storms over the Bay of Bengal and the Arabian Sea, have a very powerful message for India: climate risk has turned into economic risk without any doubt. Such events as Cyclone Montha, which hit near Kakinada with winds of about 110 km/h, tell us that the weather is changing drastically and that our everyday life is getting more and more fragile. This kind of instability is a part of a worldwide trend, which is well exemplified by the very catastrophic events like a Category 5 Hurricane Melissa that was estimated to cause losses of $6.5 billion in the Atlantic. It acts as a warning not only for the financial effects of global warming but also for the consequences of human activities that are still going on without any control.

The consequences of climate volatility in India are manifold. It affects human lives, infrastructure, and even the money system. Just this year, during the monsoon season from June to September, irregular rains, floods, and landslides have killed more than 1,500 people, and the losses have been estimated to exceed ₹24,000 crore. The extreme rainfall that has been 27% higher than the Long-Period Average by mid-October has led to the destruction of the essential infrastructures like roads, bridges, schools, hospitals, and power lines in different states. The country is also exposed to major disruptions in various sectors, including agriculture, manufacturing, mining, and tourism. Therefore, the monsoon’s behaviour has transitioned from being a natural phenomenon to an important economic variable that has the power to change growth, employment, and fiscal stability.

As losses are rising to a great extent, the first and foremost question that a policymaker should ask himself/herself would be: where is the most significant protection gap? Although insurance is a very good tool for dealing with uncertainties, the majority of India’s people and economic activities have not been insured or have been only partly insured, which means that the losses are most of the time borne by individuals and enterprises who do not have any safety net. The figures disclose the extent of this exposure to risk: almost 40 crore citizens do not have health insurance, about 100 crore citizens are without life insurance, less than 15% of MSMEs have sufficient insurance, and roughly 70% of the gross cropped area is without any protection. In order to close this gap, India is taking the first steps towards climate-linked and parametric insurance models. These instruments are intended to facilitate automatic compensation when the weather conditions set in advance, for example, the intensity of rainfall or the speed of wind, are violated. These mechanisms aim to make the process of coverage faster, data-driven, and less difficult for the most vulnerable sectors, thus constituting a necessary advancement in the transition toward climate risk financing that has the capacity to absorb shocks at scale.

As climate volatility is becoming a matter of everyday life, India has to change its disaster response strategy from a focus on reactive relief efforts–what happens after the damage—to preventive planning and risk-building. The development of a country should not be judged only by indicators like GDP or production output, but also by the level of a society’s resilience–the ability to withstand shocks without losing its flow of life. Natural disasters, in the end, bring to light not only human weakness but also the power to adjust. Every storm that has been overcome is a kind of exam of how the protective systems, the responsive communities, and the collective will to rebuild stronger are at work. Hence, real growth is more about foresight than recovery rates.

By Prerna Singh

The festival season may have passed sometime back, but it left teaching us new lessons in green tech. This started with a calm shift under the bright lights of Dussehra in Ayodhya. Devotees carried prasad in neat boxes and drank from regular-looking water bottles. They may have looked ordinary, but they were not all made from sugarcane. Not sugarcane juice: a new product known as PLA the plant-based plastic that degrades safely in composting situations. It was a mundane example with a loud message: India can respect tradition, without the burden of plastic waste.

A moment like this does not just happen. Balrampur Chini Mills (BCML) was behind it. They did not simply deliver the prasad packaging for the festival, they built a model. Their Balrampur Bioyug brand made both the prasad containers and water bottles from sugarcane PLA, which was certified to IS 17088 standards even the cap was compostable. The effort fell well within the cadence of Swachhata Hi Seva 2025. Tradition transformed into a clean, modern, sacred-sustainability story of responsibility. And the effort to partner MSME converters based in the south and the west meant that small manufacturers were now included in that story.

However, the essence of this shift goes beyond only one event. BCML is building India’s first fully integrated “sugar-to-PLA” plant, where sugarcane becomes polymer in one continuous chain using renewable energy. It will have a projected capacity of up to 80,000 tonnes a year. This is sufficient production to move from pilot scale to mainstream and achieve cost reductions over time. Currently, PLA costs nearly twice as much as PET. In practice, it is about 1.5 times more due to weight savings and being compatible with existing lines. With increased production and supportive state policy such as the Uttar Pradesh Bioplastics Policy 2024, the gap is expected to narrow even further.

Why now?

India has already banned 19 categories of single-use plastic, and that compostable claims must be verified by a third-party certification and an IS/ISO171088 credential before any product is commercially available. This leads to a level of trust and a clear direction. As a listed company, BCML also reports environmental data through SEBI’s BRSR with regard to accountability as their business scales. Experts agree, if the policy, scale, and public procurement converge compostables will rapidly move from “nice-to-have”, to standard.

The potential is considerable. India’s current PLA market is around 20,000 tonnes, but demand across cutlery, straws, personal care and food delivery is in the several lakh tonnes. With the right infrastructure and scaling, bio-based packaging can reduce landfill volumes, limit emissions, and enhance India’s position in sustainable manufacturing as the world shifts to greener alternatives. Public pilots like Ayodhya become demonstration sites people see, touch, and trust the alternative. From temple towns to urban kitchens, sugarcane is creating a new chapter of packaging that respects culture and the planet and is built to align with India’s priorities.

The gleaming solar farms stretching toward the horizon and the silent glide of electric vehicles on city streets are the visible icons of our promised sustainable future. Yet, beneath this polished surface lies a far more complex, gritty, and rapidly evolving reality: a profound revolution reshaping the very arteries that deliver green technology, which are its global supply chains. This intricate network, once relegated to the background as a logistical necessity, has surged to the forefront as the critical frontier where the true environmental and social cost of the energy transition is being determined. What was once an afterthought is now recognized as the linchpin for genuine sustainability, driving an unprecedented, multifaceted transformation that is as challenging as it is essential for the future of both the planet and the clean tech industry itself.

Mounting climate catastrophe demands drastic reductions in greenhouse gas emissions across the entire value chain, far beyond a company’s direct operations. Scope 3 emissions, encompassing everything from raw material extraction and processing to manufacturing, transportation, and end-of-life management, often constitute a crushing 70-90% of a green tech company’s total carbon footprint, according to comprehensive analyses by organizations like CDP. Simultaneously, governments are wielding regulatory power like never before. The European Union’s Carbon Border Adjustment Mechanism (CBAM), imposing carbon costs on imports of steel, aluminum, cement, fertilizers, electricity, and hydrogen starting its transitional phase in October 2023, fundamentally alters the calculus for global suppliers. The EU Battery Regulation, fully effective since February 2024, mandates rigorous carbon footprint declarations, performance and durability standards, and escalating targets for recycled content in lithium, cobalt, lead, and nickel used in batteries – a direct assault on the environmental impact of this crucial green tech component. This regulatory tsunami is echoed globally, from US incentives tied to domestic sourcing and labor standards to emerging frameworks in Asia.

Adding immense pressure is the insatiable demand for critical minerals – the lifeblood of batteries, permanent magnets in wind turbines, and advanced electronics. The International Energy Agency (IEA) projects that overall demand for critical minerals could triple by 2030, with lithium demand alone potentially increasing by over 40 times by 2040 under net-zero scenarios. This voracious appetite collides with the harsh reality that securing these resources is impossible without addressing the ethical and environmental scandals that have plagued mining: child labor in cobalt artisanal mines in the Democratic Republic of Congo, devastating water pollution from lithium extraction in South America, and land rights conflicts globally. Ethically conscious consumers, empowered investors wielding trillions in ESG-focused capital, and advocacy groups are demanding radical transparency and accountability, making unsustainable sourcing not just unethical but a severe reputational and financial liability. The revolution, therefore, is not merely desirable; it’s a fundamental requirement for securing the resources needed for the energy transition itself.

This supply chain metamorphosis manifests in profound and diverse ways across every link. At the source, mining giants face unprecedented pressure to adopt and adhere to stringent environmental and social standards. Frameworks like the Initiative for Responsible Mining Assurance (IRMA) are moving from aspirational to essential benchmarks. Pioneering companies are forging new paths: BMW secured the world’s first supply contract for carbon-reduced steel produced using green hydrogen from Sweden’s H2 Green Steel, aiming for near-zero emissions. Apple, a major consumer of cobalt for batteries, has committed to using 100% recycled cobalt in all Apple-designed batteries by 2025 and is actively auditing its supply chains down to the smelter level. The quest extends beyond recycling to innovative extraction methods like Direct Lithium Extraction (DLE), which promises significantly lower water usage and land impact than traditional evaporation ponds.

The journey of materials, which is the logistics spine, is undergoing its own radical decarbonization. Shipping, responsible for nearly 3% of global CO2 emissions, is a major target. Maersk’s bold investment in a fleet of dual-fuel container ships capable of running on green methanol represents a significant bet on alternative fuels, though scaling production remains a hurdle. Companies are leveraging artificial intelligence for sophisticated route optimization, significantly slashing fuel consumption and emissions across road, sea, and air freight. Simultaneously, the push for Sustainable Aviation Fuels (SAF) is intensifying, driven by corporate commitments to reduce supply chain emissions, though cost and availability are still significant barriers. The focus is shifting from mere efficiency to genuine decarbonization of movement.

Perhaps the most fundamental shift is the rise of the circular economy from a niche concept to a core operational necessity. The linear “take-make-dispose” model is untenable for resource-intensive green tech. Innovations in battery recycling are leading this charge. Companies like Redwood Materials, founded by Tesla co-founder JB Straubel, and Li-Cycle are developing advanced hydrometallurgical and mechanical processes aiming to recover over 95% of critical metals like lithium, cobalt, and nickel from end-of-life batteries and manufacturing scrap. This contrasts starkly with the Global Battery Alliance’s estimate that currently less than 5% of lithium-ion batteries are recycled globally, highlighting both the immense challenge and opportunity. Beyond batteries, designing products for disassembly, implementing robust take-back schemes, and establishing industrial-scale recycling for solar panels (which face a potential tsunami of waste as early deployments reach end-of-life) and wind turbine blades are critical priorities. The goal is clear: transform waste streams back into valuable feedstock, drastically reducing the need for virgin mining and its associated impacts.

Underpinning all these efforts is the rising demand for radical transparency. Gone are the days of vague sustainability promises. Blockchain technology, piloted by companies like IBM (Food Trust, now part of the IBM Environmental Intelligence Suite) and MineHub Technologies, is being explored to create immutable ledgers tracking materials from mine to final product. Comprehensive Life Cycle Assessments (LCAs) are becoming standard practice, quantifying environmental impacts across the entire product lifespan. This transparency allows companies like Patagonia (with its Footprint Chronicles) and Tesla (increasingly pressured to disclose its battery mineral sourcing) to validate their sustainability claims and empowers consumers and investors to make informed choices. Crucially, it also exposes greenwashing, holding companies accountable for their entire value chain impact.

Despite the undeniable momentum, the path is fraught with formidable hurdles. Transitioning to sustainable supply chains often carries higher initial costs for materials, logistics, and compliance. Engaging and auditing complex, multi-tiered supplier networks, often operating in regions with limited oversight, remains a herculean task. Technological limitations persist, particularly in efficiently recycling complex products and scaling green hydrogen or SAF production. Persistent gaps in global standards and verification mechanisms create confusion and loopholes. Geopolitical tensions and trade policies add another layer of complexity to securing resilient and responsible supply chains.

Yet, the trajectory is clear and irreversible. The plummeting cost of renewable energy is making green manufacturing increasingly viable. The reputational and financial risks of unsustainable practices are too great to ignore. Most fundamentally, there is a dawning, industry-wide realization: a genuinely sustainable future powered by green technology is impossible without green supply chains. The revolution transforming these once-hidden networks is no longer merely an ethical choice; it has become the indispensable bedrock of competitive resilience, resource security, and ultimately, planetary survival.

The global climate crisis demands more than incremental change; it requires a fundamental reimagining of how we produce, consume, and power our world. At the forefront of this seismic shift stand companies transcending mere compliance to become true champions of green technology and holistic sustainability. These organizations are not just deploying clean solutions; they are embedding environmental and social responsibility into their core DNA, redefining supply chains, pioneering disruptive technologies, and proving that profitability and planetary stewardship are not mutually exclusive but intrinsically linked. Their journeys, grounded in verifiable action and measurable impact, illuminate the path toward a genuinely sustainable future. Driven by a potent combination of ethical imperative, investor pressure, consumer demand, and regulatory tailwinds like the EU’s Green Deal and CBAM, these vanguards are demonstrating scalable solutions across diverse sectors, transforming ambition into tangible reality through relentless innovation and unwavering commitment.

In the critical realm of renewable energy generation and transition, Ørsted stands as a paradigm-shifting exemplar. This Danish powerhouse has undergone one of the most radical corporate transformations witnessed, evolving from Danish Oil and Natural Gas (DONG) to a global leader exclusively focused on renewables. Their audacious commitment is reflected in achieving a 94% reduction in scope 1 and 2 emissions since 2006 (validated by the Science Based Targets initiative – SBTi), with a firm target to become carbon-neutral by 2025, encompassing their entire energy generation and operations. Ørsted is not merely building wind farms; they are pioneering biodiversity protection measures like artificial reefs around turbine foundations and investing heavily in Power-to-X technologies, exploring green hydrogen and e-fuels to decarbonize harder-to-abate sectors like shipping and aviation. Their leadership extends beyond their own operations, actively engaging suppliers to reduce emissions across their value chain, understanding that true sustainability demands systemic change. Similarly, NextEra Energy, through its subsidiary NextEra Energy Resources, has become the world’s largest generator of renewable energy from wind and solar, boasting over 34 gigawatts (GW) of installed capacity as of Q1 2024 and a staggering development pipeline exceeding 20 GW. Their strategic investments in battery storage – deploying over 3 GW globally – are crucial for grid stability as intermittent renewables proliferate, showcasing an integrated approach to the clean energy transition. Their ambitious “Real Zero” goal targets eliminating all scope 1 and 2 emissions by 2045 without relying on offsets, a testament to their commitment to genuine decarbonization, backed by massive capital expenditure plans exceeding $85 billion for 2023-2026 focused on renewables and grid modernization.

The transportation sector, a major emissions source, is being revolutionized by champions like Tesla, whose impact extends far beyond popularizing electric vehicles. Tesla’s core mission accelerates the shift to sustainable energy, evidenced by deploying over 20 Terawatt-hours (TWh) of cumulative clean energy generation and storage through its solar panels and Powerwall/Powerpack/Megapack batteries as of 2023. Their relentless focus on battery technology – reducing cobalt content, increasing energy density, and driving down costs – has been instrumental in making EVs accessible. While facing scrutiny over its own supply chain, Tesla actively sources responsibly, publishing annual Impact Reports detailing mineral sourcing and recycling efforts, and its Gigafactories increasingly utilize on-site solar and aim for high levels of renewable energy use. Their vertically integrated approach, controlling battery production and software, allows for rapid innovation cycles crucial for scaling sustainable transport. Complementing vehicle electrification is the critical need for sustainable logistics, where Maersk is making bold strides. The global shipping leader has committed to achieving net-zero greenhouse gas emissions by 2040, a decade ahead of the initial IMO industry target. Their tangible action includes ordering 25 dual-fuel vessels capable of running on green methanol, with the first already operational, and securing partnerships to scale green fuel production. Maersk is actively exploring ammonia as another zero-emission fuel pathway and heavily investing in optimizing vessel operations through AI for route and speed optimization, significantly reducing fuel consumption even with conventional fuels while the green fuel infrastructure scales. Their Eco Delivery product, offering customers carbon-neutral transport using sustainable biofuels, demonstrates market-driven solutions, with volumes growing exponentially year-on-year.

The technology hardware sector, grappling with resource intensity and complex global supply chains, finds leadership in companies like Apple. Apple’s ambition is profound: to make every product carbon neutral by 2030, encompassing its entire global supply chain and product lifecycle. This requires monumental effort, and progress is tangible. They have achieved 100% renewable electricity for their global corporate operations since 2018 and are driving their vast manufacturing network – over 300 suppliers as of 2023 – toward the same goal, with commitments covering over 16 gigawatts of renewable energy online. Apple is pioneering material innovation and circularity: the latest Apple Watch models incorporate 100% recycled cobalt in batteries and 100% recycled gold in plating and wire, the MacBook Air with M3 features 50% recycled plastic and 100% recycled aluminum in the enclosure, and they are utilizing recycled rare earth elements across components. Their disassembly robots, like Daisy and Dave, and growing network of Material Recovery Labs aim to close the loop, targeting eliminating mining altogether through advanced recycling and material substitution. Patagonia, while an apparel company, operates with the ethos and impact of a green tech champion, particularly in material science and supply chain ethics. Its self-imposed “Earth tax,” the 1% for the Planet commitment, has donated over $200 million to environmental groups since 1985. Patagonia relentlessly innovates with recycled materials (over 87% of their line used recycled materials in Fall 2023), organically grown cotton (eliminating pesticides since 1996), and regenerative organic certified practices to rebuild soil health. Their radical transparency through the Footprint Chronicles traces materials back to farms and factories, holding themselves and suppliers accountable. Most significantly, founder Yvon Chouinard transferred ownership to a Purpose Trust and non-profit in 2022, ensuring all company profits fund climate and conservation efforts, structurally embedding planetary health above shareholder returns – an unprecedented corporate model prioritizing sustainability as its core fiduciary duty.

The enablers of circularity and resource recovery are equally vital champions. Redwood Materials, founded by former Tesla CTO JB Straubel, tackles the looming challenge of end-of-life batteries head-on. Their mission is to create a closed-loop domestic supply chain for critical battery materials. Their hydrometallurgical process recovers over 95% of the critical metals like lithium, cobalt, nickel, and copper from end-of-life batteries and manufacturing scrap, significantly reducing the need for environmentally damaging virgin mining and enhancing supply chain security. Redwood is rapidly scaling its Nevada operations and expanding into South Carolina, partnering with major automakers (Ford, Volkswagen, Toyota) and battery producers (Panasonic) to secure feedstock and supply recycled materials for new batteries, aiming to produce anode and cathode components with a drastically lower carbon footprint than virgin materials by 2025. In the realm of industrial decarbonization, H2 Green Steel is a pioneering force demonstrating disruptive green tech. Utilizing hydrogen produced via electrolysis powered exclusively by Sweden’s abundant renewable electricity, they are building the world’s first large-scale green steel plant in Boden. This process eliminates the fundamental need for coking coal, the source of ~90% of the steel industry’s CO2 emissions. Their offtake agreements with major manufacturers like BMW, Mercedes-Benz, and Siemens (representing over 7 billion Euros in future revenue by 2030) underscore the market demand for truly green primary steel. Their model offers a blueprint for decarbonizing one of the world’s most carbon-intensive industries, proving the technical and commercial viability of green hydrogen in heavy industrial processes.

These champions, while diverse in their sectors and strategies, share common threads: audacious, science-based targets validated by organizations like SBTi; radical transparency in reporting progress and challenges; deep integration of sustainability into core R&D and business models, not peripheral CSR; pioneering collaboration across value chains to drive systemic change; and a willingness to invest heavily upfront for long-term planetary and economic resilience. They navigate complex challenges – scaling green hydrogen and SAF, ensuring ethical mineral sourcing, perfecting large-scale recycling, managing Scope 3 emissions across sprawling networks – but their progress is demonstrable and accelerating. Their leadership proves that the green tech revolution is not just about generating clean energy but about fundamentally transforming how we build everything, from the molecules upwards, creating a circular, equitable, and truly regenerative economy. They are not merely participants in the sustainability movement; they are its architects, demonstrating through concrete action that a thriving future for business is inextricably linked to a thriving planet. Their continued innovation and scaling efforts represent humanity’s most promising engine for achieving a net-zero, nature-positive world.

On a typical day, over 100,000 flights crisscross the globe, leaving behind contrails and a staggering carbon footprint. As the world grapples with climate change, this dilemma in the area of aviation as become almost an existential challenge. The industry accounts for 2.5% of global CO₂ emissions, a figure projected to triple by 2050 without intervention. With electric planes still decades away from commercial viability for long-haul flights, and also as international travellers increasingly opt for carbon offsets, Sustainable Aviation Fuel (SAF) has emerged as the most realistic pathway to decarbonize air travel. Made from renewable sources like agricultural waste, algae, and even carbon captured from the air, SAF can reduce aviation’s carbon footprint by up to 80% compared to conventional jet fuel.

India, with its rapidly growing aviation market (projected to become the world’s third-largest by 2026) and vast agricultural resources, stands at a critical juncture. According to a Deloitte report highlighted in The Economic Times, India could produce 8-10 million tonnes of SAF annually by 2040, enough to meet 20% of its projected jet fuel demand. But will the country seize this opportunity, or remain grounded by policy inertia?

Every winter, northern India’s skies turn toxic as farmers burn an estimated 230 million tonnes of agricultural residue, primarily rice straw. This environmental catastrophe could instead become the foundation of India’s SAF industry. Praj Industries, a pioneer in biofuels, has already demonstrated that rice straw and sugarcane bagasse can be converted into drop-in aviation fuel through advanced biochemical processes.

The International Air Transport Association (IATA) sees India’s agricultural byproducts as a game-changer: “With proper collection infrastructure, India could supply enough feedstock not just for domestic needs but for export markets,” says Preeti Jain, IATA’s Assistant Director for India. The numbers support this optimism – every tonne of agricultural waste converted to SAF prevents 3 tonnes of CO₂ emissions compared to conventional jet fuel.

India’s 2.7 million tonnes of used cooking oil (UCO) generated annually presents another promising feedstock stream. Companies like Biofuels Junction are already aggregating UCO from restaurants and food processors for biodiesel production. Scaling this model for SAF could create a circular economy where Mumbai’s samosa oil eventually powers flights from Delhi to Dubai.

Despite its potential, India’s SAF industry remains in the taxiing phase. While the U.S. offers a $1.25/gallon tax credit for SAF producers and the EU mandates 2% blending from 2025, India lacks comparable incentives.

While the Bio-Aviation Turbine Fuel Policy (2021) marked a significant step in acknowledging Sustainable Aviation Fuel (SAF) as part of India’s energy transition, its impact has been limited due to a lack of enforceable regulations and financial mechanisms. The policy’s voluntary blending targets, rather than mandatory quotas, have failed to drive large-scale industry adoption. Unlike the European Union’s ReFuelEU mandate, which enforces a 2% SAF blending requirement from 2025, India’s approach relies on goodwill rather than binding commitments.

Compounding the issue is the absence of financial incentives for SAF producers. In contrast, the U.S. Inflation Reduction Act (IRA) provides a $1.25 per gallon tax credit, dramatically accelerating domestic SAF production. Without similar subsidies or tax breaks, Indian refiners and biofuel companies face prohibitive costs, making SAF three to five times more expensive than conventional jet fuel.

Additionally, India lacks standardized certification systems for alternative feedstocks like agricultural residue and used cooking oil. This regulatory gap creates uncertainty for investors and delays the scaling of new SAF production methods.

The consequences of this policy inertia are stark. An OpenPR market analysis projects that global SAF production will grow at a 40% compound annual growth rate (CAGR) through 2030, driven by aggressive mandates in the U.S. and Europe. Meanwhile, India—despite its vast agricultural waste resources and rapidly expanding aviation sector—risks falling behind in this critical energy transition. Without urgent policy reforms, the country may miss its chance to become a major SAF producer, instead becoming dependent on costly imports to meet future decarbonization targets.

The Indian Companies Betting on SAF

Praj Industries: The Biofuel Vanguard

The Pune-based company’s “Bio-Mobility” platform has already supplied test batches of SAF to Indian airlines. Their upcoming second-generation (2G) ethanol plants can be retrofitted for SAF production once economics improve.

Indian Oil: The Refinery Revolution

India’s largest oil company is converting part of its Panipat refinery to produce 87,000 tonnes/year of SAF from agricultural waste by 2025. As noted in The Economic Times, this pilot could catalyze industry-wide adoption.

Startups: The Disruptors

Three Possible Flight Paths

As India stands at the crossroads of sustainable aviation, its trajectory in the coming decades could follow one of three distinct scenarios, each with profound implications for its economy, environment, and global energy standing.

The most concerning outlook is The Laggard Scenario, where continued policy inertia leaves India dependent on imported SAF to meet international obligations. By 2040, without domestic production incentives, Indian airlines would be forced to purchase SAF at premium prices to comply with stringent EU blending mandates for Europe-bound flights. This import dependence would not only strain airline finances but also represent a missed opportunity to capitalize on India’s vast agricultural resources, keeping the country on the sidelines of the global green fuel revolution.

A more balanced middle ground emerges in The Middle Path Scenario, where measured policy interventions – perhaps a modest blending mandate of 1-2% combined with limited tax incentives – could unlock domestic SAF production of 3-5 million tonnes annually by 2040. While this would primarily serve domestic aviation needs, it would establish crucial infrastructure and know-how for future expansion. This scenario would see India meeting its own decarbonization goals while avoiding the worst aspects of import dependence, though without capturing the full economic potential of its feedstock advantages.

The most ambitious and transformative possibility is The Global Leader Scenario, where bold policy actions position India as the Saudi Arabia of sustainable aviation fuel. With aggressive blending mandates (5%+), robust production incentives, and strategic investments in feedstock supply chains, India could emerge as a major SAF exporter to Asia and Europe. This path wouldn’t just secure India’s energy independence in aviation – it would create an estimated 300,000 rural jobs in agricultural waste collection, slash farm fire pollution by 40%, and generate a staggering $15 billion in annual revenue according to Deloitte estimates. Such an outcome would transform India from an energy importer to a clean fuel powerhouse, while simultaneously addressing critical environmental and rural economic challenges.

The divergence between these scenarios underscores a critical truth: India’s future in sustainable aviation won’t be determined by technological constraints or resource limitations, but by the ambition and urgency of its policy framework in the coming years. The runway is clear – the question is whether India will taxi cautiously or accelerate toward leadership in the global SAF market.

The pieces are in place: abundant feedstock, proven technology, and hungry corporate players. What’s missing is the policy thrust – blending mandates, tax credits, and R&D funding – to get India’s SAF industry airborne.

As global aviation faces mounting pressure to decarbonize, India stands before a rare opportunity: to transform its agricultural waste into green gold, powering not just its own skies but those of the world. The question isn’t technical or economic – it’s political. Will India’s leaders have the vision to fuel this revolution?

Here is the prescription for sustainability… In a world where the pharmaceutical industry plays a pivotal role in safeguarding human health, a new, sobering reality has emerged, that the very industry tasked with healing the world is leaving behind an environmental footprint that could endanger it. From antibiotic residues flowing into rivers to emissions from manufacturing hubs in Asia, the pharmaceutical supply chain is facing growing scrutiny. The conversation is no longer just about efficacy and access; it is increasingly about sustainability.

At the heart of this reckoning is the alarming rise of pharmaceutical pollution. This is an issue spotlighted during a landmark virtual workshop hosted by Health Care Without Harm (HCWH) Europe in September 2024. The discussions revealed a stark truth: the industry’s environmental impact spans continents, with Europe heavily dependent on Active Pharmaceutical Ingredients (APIs) and generics manufactured primarily in India and China. The scale is enormous — 70% of all dispensed medications in Europe are generics, and the environmental cost of their production often lies hidden in distant countries.

Studies have shown that traces of pharmaceutical compounds, from hormones to antibiotics, are found in over 86% of global river samples, creating unintended side effects on ecosystems and accelerating threats like antibiotic resistance (AMR). With an ageing population, rising chronic illnesses, and the cascading impacts of climate change, pharmaceutical use is projected to skyrocket. In Germany alone, demand is expected to surge by up to 67% by 2045.

The challenge is as complex as it is urgent. Antibiotics, for example, once hailed as miracle drugs, are now contributing to a silent crisis. Their residues often leach into the soil and waterways, disrupting delicate microbial ecosystems and fostering resistant strains of bacteria. Recognizing this, the AMR Industry Alliance, established after the 2016 Davos Declaration, is championing responsible effluent management. It developed a Common Antibiotic Manufacturing Framework, now strengthened with an industry-backed certification scheme via the British Standards Institute. This sets stringent limits on antibiotic emissions from manufacturing plants, ensuring discharges remain below predicted no-effect concentrations.

But global adoption remains uneven. While Nordic countries have begun incorporating environmental standards into their procurement policies, others lag behind. Moreover, the World Health Organization (WHO) has stepped in with even stricter guidelines, including mandatory effluent chemical analysis. Yet, alignment between WHO’s approach and the industry’s remains a work in progress.

Sustainable procurement is emerging as a powerful lever for change. In Europe, where public healthcare accounts for a staggering 40% of GDP, greener purchasing can influence the entire supply chain. HCWH Europe is leading the charge, supporting hospitals and procurement bodies with tools like the Sustainable Procurement Index for Health and guidelines for phasing out chemicals of concern. Governments are beginning to recognize that their purchasing power can either perpetuate pollution or become a force for ecological healing.

Legislation, too, must catch up. The United Nations Environment Programme (UNEP) has pointed out that pharmaceutical pollution is still largely unregulated. The European Green Deal could become a turning point, offering a robust framework to address environmental impacts from “cradle to grave” — from production and packaging to use and disposal. Stronger laws, if implemented with nuance, could drive innovation rather than stifle access, ensuring medicines remain both affordable and environmentally responsible.

Still, legal frameworks alone are not enough. A genuine transformation of the pharmaceutical supply chain requires a paradigm shift. That means moving from treatment to prevention — reducing demand for pharmaceuticals through investments in public health, disease prevention, and lifestyle education. Healthier societies need fewer drugs, lowering both environmental and financial burdens.

Collaboration will be critical. Initiatives like the Pharmaceutical Supply Chain Initiative (PSCI) and Sweden’s PLATINEA platform demonstrate how cross-sector dialogue, involving academia, industry, governments, and civil society, can foster trust and co-create effective solutions. From researchers bridging ecotoxicology gaps to anthropologists tackling social equity, a truly sustainable pharmaceutical future must embrace systems thinking.

Transparency and accountability must also evolve. Public reporting on environmental performance should become standard practice for pharmaceutical firms, guided by global standards like the AMR Alliance’s certification scheme and the upcoming Corporate Sustainability Due Diligence Directive (CSDDD). Yet, careful implementation is vital — too much red tape could choke smaller players and disrupt global medicine access.

Ultimately, greening the pharmaceutical supply chain is not just a technical challenge, it is a moral imperative. At stake is not just the integrity of ecosystems or the purity of rivers, but the very health of the communities these medicines are meant to serve. The solutions lie in innovation, legislation, collaboration, and above all, a shared recognition that healthcare must do no harm, not only to people but to the planet we all depend on.

It’s 2037. In a recycling facility just outside Kigali, a teenage girl named Amina watches robotic arms gently disassemble discarded solar panels. She’s one of thousands in Africa’s new wave of circular economy engineers—part of a movement that’s rewriting humanity’s relationship with resources. The panels came from an EV station in Germany. Their next life? Battery enclosures in Kenya’s grid-storage farms. Nothing is wasted. Nothing is lost. Every molecule accounted for.

This is not science fiction. This is the new metabolism of the green tech world.

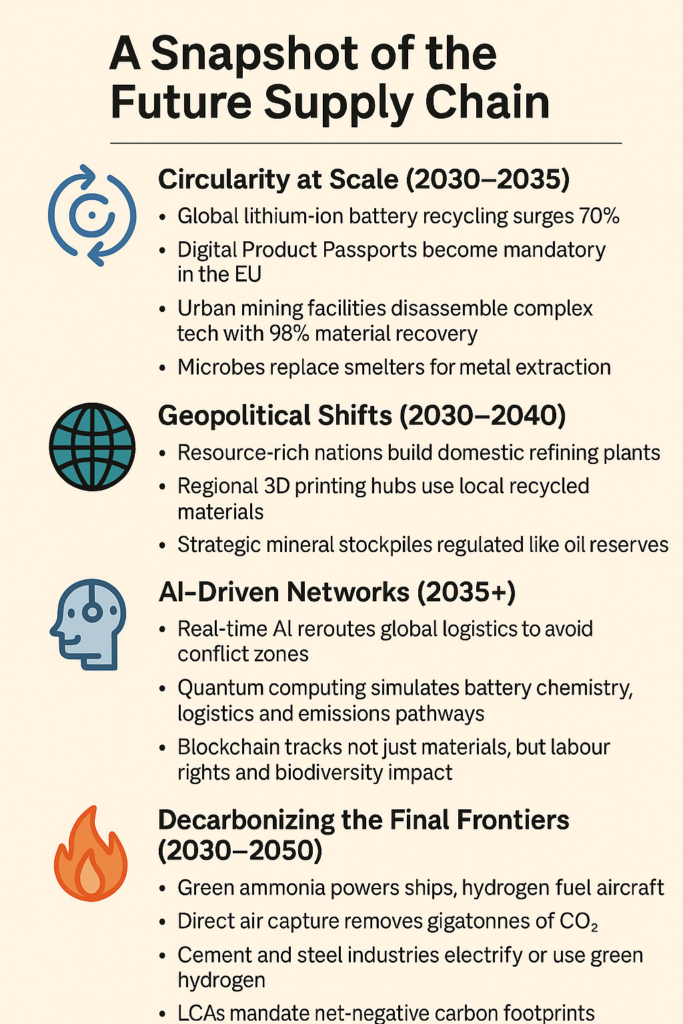

By 2030, the global supply chain isn’t just greening—it’s being reborn. The year will not be a finish line, but a pivotal inflection point where the nascent greening of global supply chains matures into a fundamental restructuring of planetary resource flows. Driven by the brutal arithmetic of climate deadlines, resource scarcity biting deeper, and the hard-won lessons of geopolitical volatility, the post-2030 green tech supply chain transcends mere decarbonization and ethical sourcing. It evolves into an intelligent, hyper-optimized, and fundamentally circular network – a living, responsive metabolic system for the clean economy, demanding unprecedented levels of collaboration, technological audacity, and systemic thinking to power humanity’s survival and prosperity in a climate-disrupted world. The linear “mine, manufacture, discard” model is rendered obsolete, replaced by dynamic loops of resource recovery, bio-integration, and localized resilience, all orchestrated by advanced digital twins and governed by planetary boundaries as the ultimate KPI.

Picture AI-powered systems that anticipate product end-of-life the moment something is made. Solar panels, wind turbines, and EV batteries aren’t discarded anymore; they’re pre-tagged in digital twins, designed for disassembly, regeneration, and reinvention. By 2035, over 70% of lithium-ion batteries are recycled—up from a dismal 10% a decade earlier. Urban mining becomes more lucrative than traditional mining, with disused electronics yielding rare metals through advanced hydrometallurgy and AI-guided recovery.

The line between technology and biology blurs. Microbes now extract nickel and cobalt from waste streams more efficiently than smelters. Mushrooms replace plastics. Genetically engineered yeast cultures birth materials that once required petroleum. And the packaging? Grown, not manufactured.

But it’s not just technology. It’s geopolitics. Across the Global South, mineral-rich nations no longer settle for exporting ore. They’re building domestic capacity—factories, battery parks, tech clusters—to refine, manufacture, and retain value. Indonesia’s nickel empire becomes a blueprint. Governments assert their “resource sovereignty,” building alliances and demanding fairer stakes in the new clean economy. Strategic stockpiles of lithium and cobalt now sit in vaults, governed by treaties, just like oil once was.

Even the most stubborn sectors yield. Aviation and shipping—long considered hard-to-abate—shift to green hydrogen and ammonia. Heavy industry electrifies. Waste heat gets recaptured. CO₂ is pulled from the air and turned into fuels or locked into stone beneath our feet. The entire system pivots from carbon emitter to carbon sink.

Behind it all? A digital nervous system humming with intelligence. Billions of sensors monitor everything—from soil moisture in lithium mines to real-time emissions in microfactories. Quantum AI models predict disruptions, optimise routes, and pre-empt shortages. A single smart algorithm in 2040 could reroute EV battery production in seconds based on weather patterns, geopolitical risks, or emissions data. Supply chains become sentient—adaptive, predictive, even self-healing.

Yet the greatest leap isn’t just technical. It’s moral.

Regeneration becomes the metric that matters. Does this supply chain restore ecosystems? Does it pay living wages? Does it honour Indigenous stewardship over mined lands? Blockchain isn’t just tracking materials; it’s verifying justice. Contracts now include biodiversity offsets. Product labels show not just carbon footprints but community benefit scores.

Because for all our smart tech, our survival hinges on something ancient: reciprocity. Giving back more than we take.

So the green tech supply chain of tomorrow isn’t just about building a better economy—it’s about healing the one we broke. It’s about reimagining not just how we produce, but how we coexist. And that future, once distant, is arriving faster than we think.

Green supply chains have emerged as a mainstay of sustainability initiatives, vowing to shrink carbon footprints and herald a new era of sustainable manufacturing and distribution. But as corporations around the world push for greener practices, we have to ask: are these supply chains actually cutting emissions, or are they just a band-aid for a bigger issue?

Green supply chains are at the core of the promise to reduce the environmental impact while ensuring operational efficiency. More companies are adopting renewable energy integration, waste reduction, low-carbon logistics, and other measures. For example, according to the International Energy Agency (IEA), nearly 30% of global electricity generation now comes from renewable energy—with some of that transition driven by the push from businesses to go to clean energy. However, although this work is admirable, the degree of its success is critically reliant on the broader systemic changes that must take place in networked supply chains.

One of the critical stages in green supply chains is the sourcing of raw materials. Electric vehicles (EVs), for example, are powered by lithium-ion batteries that use elements like lithium, cobalt, and nickel. These materials often originate from areas with serious environmental and ethical concerns. The demand for critical minerals such as lithium, the World Bank predicts, will increase nearly 500% by 2050. Companies like Tesla and BMW have focused on blockchain and other measures to ensure ethical sourcing, something that remains a challenge when factoring in the carbon emissions associated with mining and transporting these materials. COP27’s EMU report drew on a 2022 EPA study, which estimated that the extraction and processing of these minerals can make up as much as 40% of the total lifecycle emissions produced by an EV battery.

Another urgent challenge has been the resilience of green supply chains. It highlighted weaknesses in global logistics with the COVID-19 pandemic, as 85% of renewable energy companies reported disruptions. Regionalization and diversification of suppliers can help mitigate such risks, but these strategies typically incur costs. Localized manufacturing, for instance, can eliminate some transportation emissions, but if those regional facilities are powered by fossil fuels, that could create increased energy use. A 2023 report by McKinsey noted that companies that do not fully optimize their regional supply chains “risk increasing their overall carbon footprint, despite their green intentions.”

Some of these challenges could be effectively met through circular economy practices. Zero waste and zero emissions can be replaced with the productive reuse of the process and the recycling of materials. According to the Global E-Waste Monitor 2020, only 17.4% of e-waste is recycled, and this presents a huge opportunity. Indeed, battery recycling projects, like those of Umicore, work on the principle of a closed process where reuse leads to less dependence on virgin forms of material and subsequently emissions. Scaling these practices will require significant investment and coordination on a global scale, as appropriate recycling infrastructure is lacking in many areas.

Digital transformation is yet another technology touted as a game-changer for green supply chains. AI, machine learning, and the Internet of Things (IoT) facilitate seamless tracking, forecasting, and optimization of resources. A 2023 Deloitte study discovered that there is a potential to reduce supply chain emissions by as much as 30% through digital tools. Internet of Things (IoT) sensors, for instance, can measure energy consumption and detect inefficiencies on a live basis, whereas AI analytics can plan logistics in a way that reduces fuel usage. Read more on the impact of technology on the environment and production: Experts warn of carbon glut from soaring number of computers. For example, a large server complex may consume as much energy as a small city, and the materials needed to manufacture and maintain these digital systems can be quite extensive.

To address the multiple challenges posed by green supply chains, stakeholders need to collaborate. It takes governments, corporations, and consumers working together to create standards and incentives for sustainability. The International Renewable Energy Agency (IRENA) reported that public-private partnerships have already mobilized over $2 trillion for clean energy projects since 2015. However, substantial cuts in emissions will require changes well beyond capital deployment and even regulatory structures and consumer behavior. For example, organizations like the RE100 coalition, in which companies join to aim for 100% renewable energy, show the potential for collective action, though also the importance of accountability and transparency.

Overall, although there is a great potential contribution of green supply chains to emissions reduction, the current impact is uneven. Many efforts are either make-work projects that are not integrated into operations, or they simply rely on what I describe as a greenwashing meme, where large organizations claim goals and achievements that sound good but aren’t based on an integrated approach to operations. This will require more than gradual steps toward green supply chains; it means developing integrated approaches that address the entire supply chain from material extraction through to end-of-use recycling. The journey to real sustainable supply chains is a long and winding one, and the stakes couldn’t be higher. The transition to effective, transparent, and truly green supply chains has never been more urgent as climate change speeds up. Corporates who can crack this nut will be able to achieve lower carbon footprints while building a blueprint for a sustainable future and demonstrating that economic development and protection of the environment can be mutually reinforcing.”

How to distinguish true green initiatives from mere marketing ploys?

It’s no secret that in today’s market, sustainability is one of the most potent selling points, and brands have been desperate to present themselves as guardians of the environment. It’s a common refrain in marketing that consumers want their purchases to match their values, and advertising is packed with words like “eco-friendly,” “carbon neutral,” and “sustainable,” reaching out to those consumers. But beneath the glossy campaigns and enticing labels, not all things green are as they appear. However, greenwashing, where companies overhype or lie about their eco-credentials, has made it harder than ever to decipher which sustainability claims are genuine and which are a marketing gimmick.

Greenwashing, a phrase first used in the 1980s, refers to misleading behaviours that make a company or product seem greener than it actually is. Rather than implementing meaningful changes, many firms spend big on snazzy marketing and nebulous commitments designed to attract environmentally aware consumers. The scale of the problem is staggering. According to a 2021 research report from The Changing Markets Foundation, 59% of fashion brands’ green claims are misleading or unsupported. In a similar vein, a new report from TerraChoice found that 98% of products in North America making environmental claims had at least one instance of greenwashing

So why does greenwashing persist and sustainability sell in the marketplace? According to a NielsenIQ study from 2022, 72% of consumers worldwide look for sustainable attributes on products. It is in this context that this new consumer shift prioritizes businesses that can entice buyers through their green credentials — even if, for many, they are more skin-deep than significant.

Even as greenwashing comes under greater scrutiny, regulations are uneven. Terms such as “natural,” “eco-friendly,” or “biodegradable” usually have little in the way of standardized definition, allowing companies to take advantage of these ambiguities. While organizations such as the Federal Trade Commission (FTC) in the United States and the European Commission have recently released guidelines to reduce greenwashing, enforcement is sporadic at best.

True sustainability entails major investment in technology, sustainable materials, and restored processes. For many businesses, it allows a cheaper shortcut: the ability to say they care about the environment without having to actually change anything

Consumers can better protect themselves by learning to spot red flags in marketing. Ambiguous declarations like “eco-friendly” without concrete metrics or evidence are common strategies. Some brands invoke meaningless certifications, or they prioritize one attribute, like recycled packaging, to the exclusion of even larger environmental costs, like overexploitation in the food or timber supply chain. Actual sustainability is marked by transparency. And companies dedicated to meaningful change are transparent about their processes, struggles, and evolutions. In contrast, greenwashing businesses usually employ vagueness when discussing their practices.

True sustainability is not just about making claims in marketing but rather involves the incorporation of environmental accountability into every step of a business’s processes. Authenticity is about measurable goals and transparent progress reporting. For example, Unilever’s Sustainable Living Plan saw 32% fewer carbon emissions from energy consumption in 2008 compared to 2021—an example of leadership, accountability, and long-term change. Reputable certifications such as B Corp, FSC (Forest Stewardship Council), and LEED indicate a commitment to rigorous sustainability standards. Independent endorsements help consumers separate the action from the lip service.

Real sustainability encompasses a product’s entire lifecycle from sourcing through disposal. Patagonia is one example that uses recycled materials, offers repair services, and promotes second-hand purchases to reduce waste. Real brands own up to their faults and explain how they will change. This kind of honesty inspires trust, separating them from the smooth, frequently overblown stories of greenwashing corporations.

Greenwashing is no victimless crime. Aside from duping consumers, it has dire implications for environmental progress and corporate trust. When consumers discover deceptive practices, it undermines their trust in brands and sustainability initiatives more broadly. Some 40% of consumers are skeptical regarding companies’ green claims, according to a 2021 GlobalWebIndex survey, underscoring the widespread distrust that greenwashing creates. Greenwashing hinders genuine action toward addressing environmental issues by distracting away valuable time and resources from actual solutions. Performative companies slow the pace of much-needed change.

Brands that get caught greenwashing run into backlash from regulators and consumers both. The surrounding controversy was an embarrassing blow, putting its credibility at risk and opening the door to a potential lawsuit. Genevieve Mather: A call to action — Businesses can contribute to the solution and consumers have a role in demanding change.

For corporates, it’s not your quotes now, focus on actions. While it may provide little reward initially, investing in sustainability, providing transparency, and working with the supply chain to address systemic challenges will pay dividends in the long run. Transparent communication on successes and shortcomings will create trust and credibility in an ever-more eco-conscious marketplace.

Consumers also have a great deal of power. Advocating for better practices and backing brands with concrete sustainability records will ultimately force industry-wide reform. Researching, looking for trustworthy certifications, and questioning vague statements are important steps in trying to make sure their decisions align with their values.

Greenwashing really is a betrayal of the fight against climate change; it masks what often is not real advancement while systemic environmental problems continue. As the problem is coming to understand and regulations have tightened, it will become very evident what is lip service and what is substantive action.

Transparency, accountability, and collaboration are the road to sustainability. For businesses, it’s simple: commit to true environmental responsibility and you’ll build trust and brand loyalty. Consumers can safeguard a cleaner future through vigilance and informed choices about what to buy. These efforts revolve towards a world where sustainability is not just a marketing tactic but a common pledge to a good environment.

Copyright © 2026 Green Trendsetters. Terms of use. Privacy policy.