The gleaming solar farms stretching toward the horizon and the silent glide of electric vehicles on city streets are the visible icons of our promised sustainable future. Yet, beneath this polished surface lies a far more complex, gritty, and rapidly evolving reality: a profound revolution reshaping the very arteries that deliver green technology, which are its global supply chains. This intricate network, once relegated to the background as a logistical necessity, has surged to the forefront as the critical frontier where the true environmental and social cost of the energy transition is being determined. What was once an afterthought is now recognized as the linchpin for genuine sustainability, driving an unprecedented, multifaceted transformation that is as challenging as it is essential for the future of both the planet and the clean tech industry itself.

Mounting climate catastrophe demands drastic reductions in greenhouse gas emissions across the entire value chain, far beyond a company’s direct operations. Scope 3 emissions, encompassing everything from raw material extraction and processing to manufacturing, transportation, and end-of-life management, often constitute a crushing 70-90% of a green tech company’s total carbon footprint, according to comprehensive analyses by organizations like CDP. Simultaneously, governments are wielding regulatory power like never before. The European Union’s Carbon Border Adjustment Mechanism (CBAM), imposing carbon costs on imports of steel, aluminum, cement, fertilizers, electricity, and hydrogen starting its transitional phase in October 2023, fundamentally alters the calculus for global suppliers. The EU Battery Regulation, fully effective since February 2024, mandates rigorous carbon footprint declarations, performance and durability standards, and escalating targets for recycled content in lithium, cobalt, lead, and nickel used in batteries – a direct assault on the environmental impact of this crucial green tech component. This regulatory tsunami is echoed globally, from US incentives tied to domestic sourcing and labor standards to emerging frameworks in Asia.

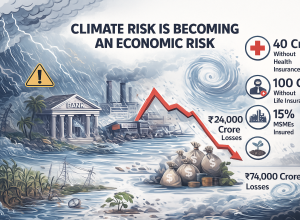

Adding immense pressure is the insatiable demand for critical minerals – the lifeblood of batteries, permanent magnets in wind turbines, and advanced electronics. The International Energy Agency (IEA) projects that overall demand for critical minerals could triple by 2030, with lithium demand alone potentially increasing by over 40 times by 2040 under net-zero scenarios. This voracious appetite collides with the harsh reality that securing these resources is impossible without addressing the ethical and environmental scandals that have plagued mining: child labor in cobalt artisanal mines in the Democratic Republic of Congo, devastating water pollution from lithium extraction in South America, and land rights conflicts globally. Ethically conscious consumers, empowered investors wielding trillions in ESG-focused capital, and advocacy groups are demanding radical transparency and accountability, making unsustainable sourcing not just unethical but a severe reputational and financial liability. The revolution, therefore, is not merely desirable; it’s a fundamental requirement for securing the resources needed for the energy transition itself.

This supply chain metamorphosis manifests in profound and diverse ways across every link. At the source, mining giants face unprecedented pressure to adopt and adhere to stringent environmental and social standards. Frameworks like the Initiative for Responsible Mining Assurance (IRMA) are moving from aspirational to essential benchmarks. Pioneering companies are forging new paths: BMW secured the world’s first supply contract for carbon-reduced steel produced using green hydrogen from Sweden’s H2 Green Steel, aiming for near-zero emissions. Apple, a major consumer of cobalt for batteries, has committed to using 100% recycled cobalt in all Apple-designed batteries by 2025 and is actively auditing its supply chains down to the smelter level. The quest extends beyond recycling to innovative extraction methods like Direct Lithium Extraction (DLE), which promises significantly lower water usage and land impact than traditional evaporation ponds.

The journey of materials, which is the logistics spine, is undergoing its own radical decarbonization. Shipping, responsible for nearly 3% of global CO2 emissions, is a major target. Maersk’s bold investment in a fleet of dual-fuel container ships capable of running on green methanol represents a significant bet on alternative fuels, though scaling production remains a hurdle. Companies are leveraging artificial intelligence for sophisticated route optimization, significantly slashing fuel consumption and emissions across road, sea, and air freight. Simultaneously, the push for Sustainable Aviation Fuels (SAF) is intensifying, driven by corporate commitments to reduce supply chain emissions, though cost and availability are still significant barriers. The focus is shifting from mere efficiency to genuine decarbonization of movement.

Perhaps the most fundamental shift is the rise of the circular economy from a niche concept to a core operational necessity. The linear “take-make-dispose” model is untenable for resource-intensive green tech. Innovations in battery recycling are leading this charge. Companies like Redwood Materials, founded by Tesla co-founder JB Straubel, and Li-Cycle are developing advanced hydrometallurgical and mechanical processes aiming to recover over 95% of critical metals like lithium, cobalt, and nickel from end-of-life batteries and manufacturing scrap. This contrasts starkly with the Global Battery Alliance’s estimate that currently less than 5% of lithium-ion batteries are recycled globally, highlighting both the immense challenge and opportunity. Beyond batteries, designing products for disassembly, implementing robust take-back schemes, and establishing industrial-scale recycling for solar panels (which face a potential tsunami of waste as early deployments reach end-of-life) and wind turbine blades are critical priorities. The goal is clear: transform waste streams back into valuable feedstock, drastically reducing the need for virgin mining and its associated impacts.

Underpinning all these efforts is the rising demand for radical transparency. Gone are the days of vague sustainability promises. Blockchain technology, piloted by companies like IBM (Food Trust, now part of the IBM Environmental Intelligence Suite) and MineHub Technologies, is being explored to create immutable ledgers tracking materials from mine to final product. Comprehensive Life Cycle Assessments (LCAs) are becoming standard practice, quantifying environmental impacts across the entire product lifespan. This transparency allows companies like Patagonia (with its Footprint Chronicles) and Tesla (increasingly pressured to disclose its battery mineral sourcing) to validate their sustainability claims and empowers consumers and investors to make informed choices. Crucially, it also exposes greenwashing, holding companies accountable for their entire value chain impact.

Despite the undeniable momentum, the path is fraught with formidable hurdles. Transitioning to sustainable supply chains often carries higher initial costs for materials, logistics, and compliance. Engaging and auditing complex, multi-tiered supplier networks, often operating in regions with limited oversight, remains a herculean task. Technological limitations persist, particularly in efficiently recycling complex products and scaling green hydrogen or SAF production. Persistent gaps in global standards and verification mechanisms create confusion and loopholes. Geopolitical tensions and trade policies add another layer of complexity to securing resilient and responsible supply chains.

Yet, the trajectory is clear and irreversible. The plummeting cost of renewable energy is making green manufacturing increasingly viable. The reputational and financial risks of unsustainable practices are too great to ignore. Most fundamentally, there is a dawning, industry-wide realization: a genuinely sustainable future powered by green technology is impossible without green supply chains. The revolution transforming these once-hidden networks is no longer merely an ethical choice; it has become the indispensable bedrock of competitive resilience, resource security, and ultimately, planetary survival.